- Maximizing Your Investments: Top Assets for Small Budgets - June 20, 2023

- Investing Made Easy: A Beginner’s Guide to Index Funds - March 30, 2023

- Do Index Funds Have Fees? [Don’t Overpay] - March 21, 2023

Stocks make for excellent long-term investments.

Do you want to invest in the stock market but don’t know where to start?

The internet is packed with all types of misinformation about investing and personal finance. A lot of people create content online but the majority of them don’t know what they’re talking about. With all the information out there, you could be left feeling confused, not knowing what to do.

Investing your money can be a daunting task. After all, you worked hard for the money you’ve earned and don’t want to lose it.

But don’t worry, I’m going to show you the best stock market investing strategy: The 3-fund portfolio.

The 3-fund portfolio is the easiest way to start investing in the stock market. It requires no previous experience, and anyone can be successful with this investment strategy.

Once you take the time to learn the details and reasoning behind this strategy, it’s super easy to set up and maintain.

What is an index fund?

Before we get into the details, you need to know what an index fund is.

An index fund is a basket full of different stocks that acts as one single investment.

For example, say you wanted to invest in stocks of the top 500 companies in the United States. Going out and buying all 500 companies would be too time-consuming and even more difficult to maintain.

Instead of investing in 500 individual stocks, all you would have to do is buy an S&P 500 index fund. The index fund acts as a single investment, but contains all 500 stocks!

Let me give you an example to help you understand.

Imagine that you want to buy a wide variety of different types of candies. Rather than spending hours at the store, trying to choose the best ones, all you would have to do is buy a goodie basket. A goodie basket already contains a wide variety of different candies, which saves you so much time and effort.

The same concept applies to index funds. An index fund is a basket of many different stocks that acts as a single investment.

Buy an index fund, and you’re buying all the companies that the index fund invests in.

Now that you understand what index funds are, let’s go over what a 3-fund portfolio is.

What is the 3-fund portfolio?

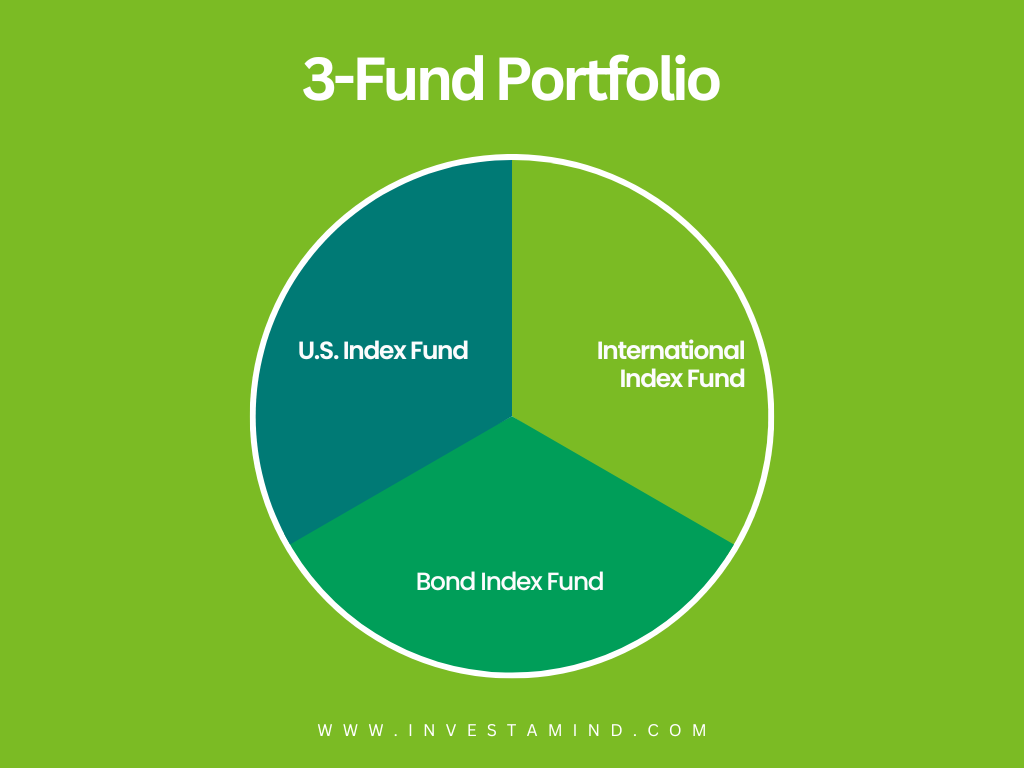

The 3-fund portfolio is just like the name implies; your portfolio will only consist of three funds. It’s the simplest way to gain diversification across many different stocks and markets.

A 3-fund portfolio consists of the following:

- One domestic stock index fund

- One international stock index fund

- One total bond market index fund

Why invest in index funds?

Now, you might be thinking, “why not invest in individual stocks?” “Why should I use the 3-fund portfolio to invest in index funds?”

You can invest in individual stocks but it’s risky and a lot of people, including experts fail to succeed. It’s a different strategy that requires you to know how about fundamental analysis and how to evaluate businesses.

Did you know that even market experts who dedicate their whole careers to fundamental analysis find it difficult to beat the market average?

In 2021, almost 80% of fund managers failed to beat the market. That’s some crazy odds!

Let me show you some more examples of why index funds are king.

Index funds outperform mutual funds

Mutual funds are just like index funds, except they’re actively managed.

That means that the fund manager actively tries to outperform the market average by picking stocks they think will perform well.

These fund managers dedicate their whole careers to studying the economy and the stock market and often consist of a whole team of experts.

Despite their expertise, a large majority of mutual funds underperform the market.

The Little Book of Common Sense Investing mentions a study that tracked 355 funds from 1970 to 2005 to see which ones could outperform the market average.

Out of the 355 funds, 223 went out of business, 48 performed the same as the market average, and 24 funds outperformed.

In other words, 80% of the funds went out of business, 13% performed the same as the market average, and only 7% outperformed.

Those odds are stacked highly against your favor. You only had a 7% chance of choosing the right fund to invest in.

Index funds are cheap

Even if you got lucky and chose one of the funds in the 7%, your portfolio would’ve been eaten up by fees.

The average actively-managed mutual fund charges an expense ratio of around 0.5%, while an index fund would only cost around 0.02%.

Those numbers may not look like a big difference, but let me break down the calculations.

Let’s say you start with $1,000 and add $5,000 every year for the next 30 years with a rate of return of 9%.

With an expense ratio of 0.5%, your final portfolio after 30 years would be $685,423.14, and you would’ve paid more than $70,000 in fees.

On the other hand, an expense ratio of 0.02% after 30 years would’ve allowed your capital to grow up to $753,169.00, and you would’ve only paid $2,974 in fees.

I don’t know about you, but I see a huge difference in fees just by looking at that chart.

Fees are one of your greatest enemies when it comes to investing. They take money out of your pocket and put them into the pockets of the fund managers.

Past performance does not guarantee future results

Just because a fund performed well in the past, does not mean it can continue to perform well in the future.

As a matter of fact, Morningstar conducted a study on more than 10,000 funds and found out that only 14% of the funds were able to keep up with their performance.

The remaining 86% were not able to keep up with their performance.

Past performance is a great way to see how well an investment performed in the past but doesn’t guarantee anything in the future.

Index funds buy the whole market

As technology advances, trends change, and companies come and go.

Even the strongest of companies might go bankrupt – you never know what may happen.

Take General Motors as an example. Back in 2008, they were one of the largest companies with the highest revenue out of the top companies in the United States. They had a bright future ahead but almost went bankrupt. The U.S. government had bought a large portion of the company to keep it from going out of business.

If you were to invest in a company that went bankrupt, you would lose the money you invested.

At the time of this posting, the top 10 companies in the United States are the following:

- Apple

- Microsoft

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- Alphabet Class A

- Exxon Mobil Corporation

- Johnson & Johnson

- Alphabet Class C

Now let’s see what this same list would look like back in 2008.

- Wal-Mart

- Exxon Mobil Corporation

- Chevron Corporation

- General Motors Corporation

- ConocoPhillips

- General Electric Company

- Ford Motor Company

- Citigroup, Inc.

- Bank of America

- AT&T Inc.

Can you see how different these two lists look? The two lists are only about two decades apart, but look at how big the change has been.

Instead of choosing to invest in individual stocks, an index fund would allow you to diversify your money across many different stocks. If one company were to go bankrupt, it would automatically be removed from the fund, thus putting your money at less risk compared to individual stocks.

Index funds are tax-efficient

Index funds are highly tax-efficient because they are passively managed to track a benchmark. The average turnover rate for an index fund is usually less than 3%, compared to a mutual fund of around 30%-60%.

Unlike index funds, mutual funds are constantly trying to outperform the market. Because of this, they are constantly buying and selling stocks.

This triggers short-term capital gains tax which means you would be taxed at your ordinary income tax bracket. The tax triggers are passed onto the investor, so you would have to pay.

This is something you want to avoid, as short-term capital gains tax is higher than long-term capital gains.

Mutual funds are highly dependent on their investors

When an actively-managed mutual fund starts to perform well, it gets popular.

As it gets popular, more people will invest more of their money into the fund in hopes to get their share of high returns.

However, as people begin to buy into this fund, it forces the fund manager to buy more stocks after the price has rallied.

On the other hand, when the fund doesn’t do so well and stock prices begin to fall, people panic. They see their hard-earned money diminishing and quickly sell out of the fund.

This causes the fund manager to sell stocks at lower prices than they were purchased at.

In other words, the fund manager has no choice but to buy when the market is overpriced and sell after stock prices have fallen.

This is the exact opposite of what anyone should be doing! You should be buying low, and selling high.

By investing in index funds, you would easily be able to avoid all of these risks.

Now that we’ve covered why index funds are king, let’s dive into the details about the 3-fund portfolio.

The Domestic Index Fund

First up, you’re going to need a domestic index fund that invests in domestic stocks.

There are two different types of domestic index funds:

- An S&P 500 Index Fund: an index fund that invests in the top 500 companies in the United States

- A Total Market Index Fund: an index fund that invests in all companies in the United States, including small ones

A total market index fund invests around 20% of its portfolio in mid-cap and small-cap businesses, which are smaller companies, while an S&P 500 index fund invests 100% in large-cap.

It would be better to invest in a total market index fund because it covers the whole market. However, the choice is up to you.

If you feel more comfortable holding only the top 500 companies, that’s fine as well. The performance of the two funds has historically been almost identical.

Here are three S&P 500 Index Funds you can choose from:

Here are three total market index funds you can choose from:

The three in each category are basically the same thing, just offered by three different companies.

The International Index Fund

The second index fund to invest in for our 3-fund portfolio is an international index fund.

You may be thinking that investing in international markets is risky, but that’s far from the truth.

As a matter of fact, when developing countries experience their economic boom, you’re going to want to be a part of it.

Developed countries such as the U.S. and countries in Europe have already experienced their economic boom. Although they may continue to grow, emerging markets, or developing countries, can provide much more upside.

Despite popular belief that international markets are risky, they actually represent more than half of the value of the global stock market.

Think of all the things we own that are products of international businesses. How many times have you seen a Toyota or Honda on the road? What about a B.M.W.? Do you own or do you know someone that owns a Samsung phone, likes to eat Kit Kat chocolates or has pumped gas at a Shell gas station?

I can go on and on. All these companies are not American and are based in foreign countries. Can you see all the investment opportunities you’d be missing by only sticking to domestic stocks?

Furthermore, there’s no guarantee that the United States will always be the powerhouse it is today.

Take a look at Japan as an example. Back in the 1980s, Japan experienced an economic boom that boosted its economy to second in the world.

Out of the top 10 most valuable global companies in the world, six were Japanese.

Everything was looking good for Japan, and no one was expecting anything to go wrong. But in the 1990s, the economic bubble popped. Today, more than 30 years later, Japan’s stock market has barely recovered to its previous all-time highs.

An important lesson from Japan: diversify outside of domestic borders.

Here are three international index funds you can choose from the same companies as above:

Combining Both Funds

Do you want an even simpler solution to combine these two funds?

Vanguard has done the job. Vanguard’s Total World Stock Index Fund invests in both domestic and international, effectively combining the two into one index fund.

It invests in approximately 60% domestic, and 40% international.

The only downside with this fund is that you won’t be able to change the domestic vs. international allocation since it’s combined into one fund.

The Bond Index Fund

This is the last index fund we will go over for our 3-fund portfolio.

Investing in bonds is a great way to add diversification to your portfolio, but it’s a bit different than the other two funds.

You may, or may not, want to invest in bonds.

Think of bonds as a tool you can use to decrease risk and volatility in your portfolio. They are income-producing assets but have a low yield, generally around 2% per year (as opposed to stocks 9% per year).

If you’re young and able to handle risk, investing heavily in bonds will most likely decrease your return on investment because of the low yield.

Bonds are generally reserved for people who are nearing retirement or people who are risk-averse and don’t like to take on too much risk.

So, the question you must ask yourself is this:

Are you willing to take on more risk/volatility for more profit? Or are you more risk-averse, preferring to sacrifice some upside in exchange for peace of mind?

This is a personal choice and it’s entirely up to you.

In the next section, I’m going to show you a neat tool you can use to test out how adding or subtracting bonds from your portfolio can change your returns.

You can use this tool to test out different allocations.

Before we move on, here are three bond index funds you can choose from:

These bond index funds invest in all types of bonds and can add great diversification to your portfolio.

Asset Allocation

An “asset allocation” is defined by how much of your money you invest in different asset classes such as stocks and bonds.

For example, if you invest 80% of your money in stocks and 20% of your money in bonds, you have a stock/bond asset allocation of 80/20.

Asset allocation does not have a one-size-fits-all rule. It’s a personal preference.

Now, let me introduce the tool I mentioned earlier. It’s called Portfolio Visualizer.

Portfolio Visualizer is a great tool you can use to test out how different asset allocations have behaved in the past. You can then see which asset allocation you would be most comfortable holding.

Let’s go over how to use it.

Once you open the website, you should see the following page below. Click on “Backtest Asset Allocation” next to the red arrow.

Scroll down to “Asset Allocation,” and select the following from the dropdown menu.

This will create our 3-fund portfolio. From there, you can start testing out different asset allocations.

Let’s say for example you wanted to compare how allocating 10% bonds to your portfolio would change the returns. You can use “Portfolio #1” to enter the first portfolio without bonds and “Portfolio #2” to enter the second with 10% bonds.

Click on “Analyze Portfolios” and compare the two.

Use this tool to see which asset allocation you would be comfortable holding. Play around with different bond allocations. Take note of the “Max. Drawdown” column to see if you could hold that allocation without panicking.

One thing to keep in mind is you don’t want to be concentrated too much in either domestic or international.

For example, a 90% U.S. total market index fund and 10% international would give too much weight towards domestic.

Still don’t know how much you should allocate to domestic vs. international?

We can use Vanguard’s Total Stock Market Index Fund, the fund I mentioned earlier, as a good starting point.

Vanguard’s Total Stock Market Index Fund’s Asset Allocation:

- Domestic: 60%

- International: 40%

This gives both domestic and international a reasonable amount of weight, with a slight bias towards domestic.

You can always change your allocation later down the road, so don’t stress out too much about it.

Play around with the tool and see what best fits you.

Conclusion

The 3-fund portfolio is one of the simplest ways, if not, the simplest way to start investing today.

It’s easy to maintain, stress-free, and barely requires any effort to set up.

The only thing left is to determine how much you should invest each month and stick with your plan. Don’t overspend and learn how to save money.

I hope you learned something from today’s post!