- Maximizing Your Investments: Top Assets for Small Budgets - June 20, 2023

- Investing Made Easy: A Beginner’s Guide to Index Funds - March 30, 2023

- Do Index Funds Have Fees? [Don’t Overpay] - March 21, 2023

Are you wondering which Fidelity International Index Fund you should invest in?

Investing internationally is an important part of your portfolio, and you should make sure you’re investing in a decent fund.

I’m going to break down three of the top international index funds offered by Fidelity to show you which one you should invest in.

If you have a Vanguard account, I have another post that compares FTIHX vs. VTIAX.

Without wasting any time, let’s dive right in.

FTIHX vs. FSGGX vs. FSPSX

The three Fidelity international index funds I want to talk about today are the following:

- FTIHX – Fidelity Total International Index Fund

- FSGGX – Fidelity Global ex U.S. Index Fund

- FSPSX – Fidelity International Index Fund

The names appear nearly identical, but they are quite different from each other when you dive into the details.

Read More >> My full “free” tutorial on index fund investing.

Inception Date

The fund’s inception date is the day it was launched to the public.

As you can see, FSPSX is the oldest among the three, as the other two were launched over a decade later.

| FTIHX | FSGGX | FSPSX |

| June 7, 2016 | September 8, 2011 | November 5, 1997 |

Benchmark

The benchmark is the standard that the Fidelity index fund tracks. The fund’s performance can be measured against the benchmark to see how well they’re performing.

Instead of just simply tracking its benchmark, FSGGX uses “statistical sampling” to determine its holdings. According to their website, the “statistical sampling techniques [are] based on such factors as capitalization, industry exposures, dividend yield, price/earnings ratio, price/book ratio, earnings growth, country weightings, and the effect of foreign taxes…” I was not able to find any more information on this.

| FTIHX | FSGGX | FSPSX |

| Morgan Stanley Capital International All Country World Index (MSCI ACWI) ex USA Index | Uses statistical sampling to attempt to replicate the returns of the Morgan Stanley Capital International All Country World Index (MSCI ACWI) ex USA Index | Morgan Stanley Capital International Europe, Australasia, Far East Index |

Expense Ratio

A fund’s expense ratio is how much the fund is going to charge you per year. This expense ratio goes to operating costs and management fees.

All three funds have an extremely low expense ratio, which is negligible.

| FTIHX | FSGGX | FSPSX |

| 0.06% | 0.055% | 0.035% |

| $6.00 for every $10,000 invested per year | $5.50 for every $10,000 invested per year | $3.50 for every $10,000 invested per year |

More >> Learn more about index fund expense ratios

Assets Under Management (AUM)

AUM is the total amount of money that people currently have invested in the fund.

FSPSX is more than quadruple in size compared to the other two. This is expected, as it has been around the longest. It is also worth mentioning that a higher AUM does not automatically imply a better investment.

| FTIHX | FSGGX | FSPSX |

| $8.3 billion | $7.9 billion | $34 billion |

Holdings

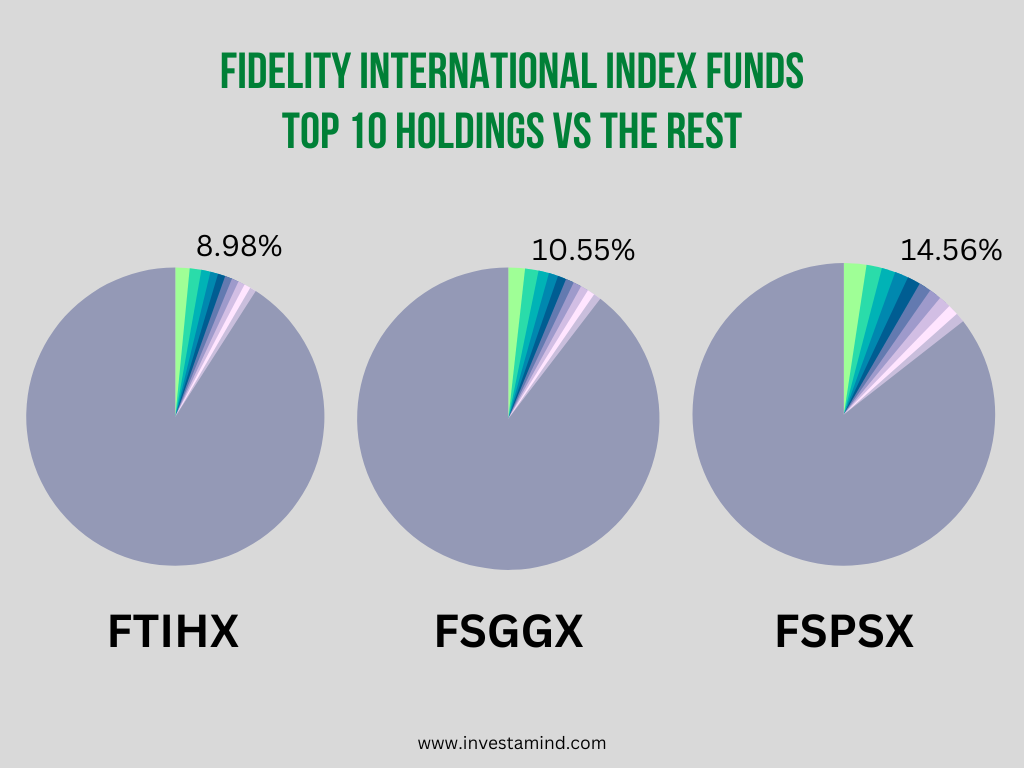

Below is a list of the top 10 holdings of each fund, and the number of holdings in total.

FTIXH is the most diversified, with more than 5,000 holdings. On the other hand, FSPSX only has 816 holdings and is the only one out of the three with different top 10 holdings. Because FSPSX has fewer holdings in total, it gives the most weight to the top 10.

| FTIHX | FSGGX | FSPSX | |

| 1 | Taiwan Semiconductor (1.40%) | Taiwan Semiconductor (1.64%) | Nestle (2.45%) |

| 2 | Nestle (1.31%) | Nestle (1.53%) | Roche Hldgs AG (1.84%) |

| 3 | Roche Hldgs (0.95%) | Roche Hldgs (1.15%) | Shell PLC (1.48%) |

| 4 | Tencent Holdings (0.91%) | Tencent Holdings (1.06%) | AstraZeneca PLC UK (1.37%) |

| 5 | Shell PLC (0.79) | Shell PLC (0.93%) | ASML Holding (1.35%) |

| 6 | Samsung (0.75%) | Samsung (0.87%) | Novartis (1.32%) |

| 7 | AstraZeneca PLC UK (0.73%) | AstraZeneca PLC UK (0.86%) | Novo-Nordisk (1.32%) |

| 8 | ASML Holding (0.72%) | ASML Holding (0.85%) | LVMH Moet Hennessy (1.31%) |

| 9 | Novo-Nordisk (0.71%) | Novo-Nordisk (0.83%) | Toyota (1.11%) |

| 10 | Novartis (0.71%) | Novartis (0.83%) | BHP Group Limited (1.00%) |

| % of portfolio | 8.98% | 10.55% | 14.56% |

| Total Holdings | 5,078 | 2,380 | 812 |

Minimum Investment Requirement

All three funds have a $0 minimum investment requirement.

That means you can start investing with just one dollar!

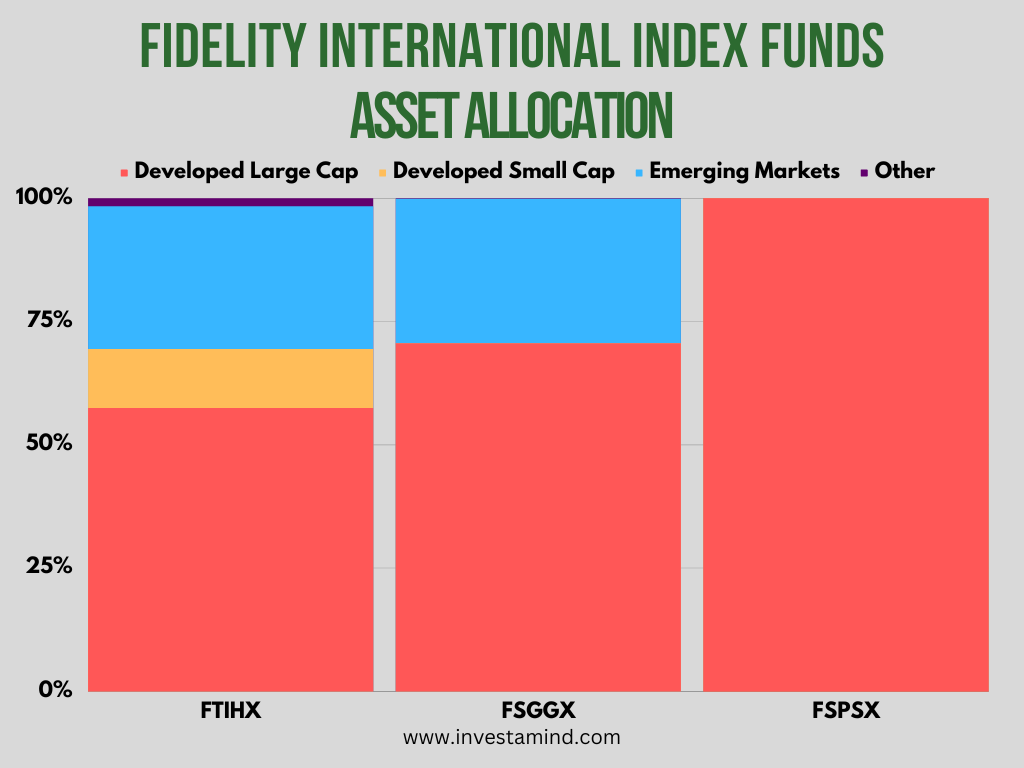

Asset Allocation

Let’s take a look at how each fund allocates its assets.

FTIHX is the only one that covers developed large cap, developed small cap, and emerging markets. Emerging markets include developing countries such as India, China, Mexico, Russia, Brazil, and Saudi Arabia. The other 2.09% is invested into futures, options, and swaps.

FSGGX does not invest in developed small cap, and FSPSX completely leaves out small cap and emerging markets.

| FTIHX | FSGGX | FSPSX | |

| Developed Large Cap | 57.48% | 70.62% | 100.00% |

| Developed Small Cap | 11.99% | 0% | 0% |

| Emerging | 28.94% | 29.31% | 0% |

| Other | 1.59% | 0.07% | 0.00% |

More >> Did you know that the 3-fund portfolio is the simplest and easiest strategy to reduce risk and increase your returns?

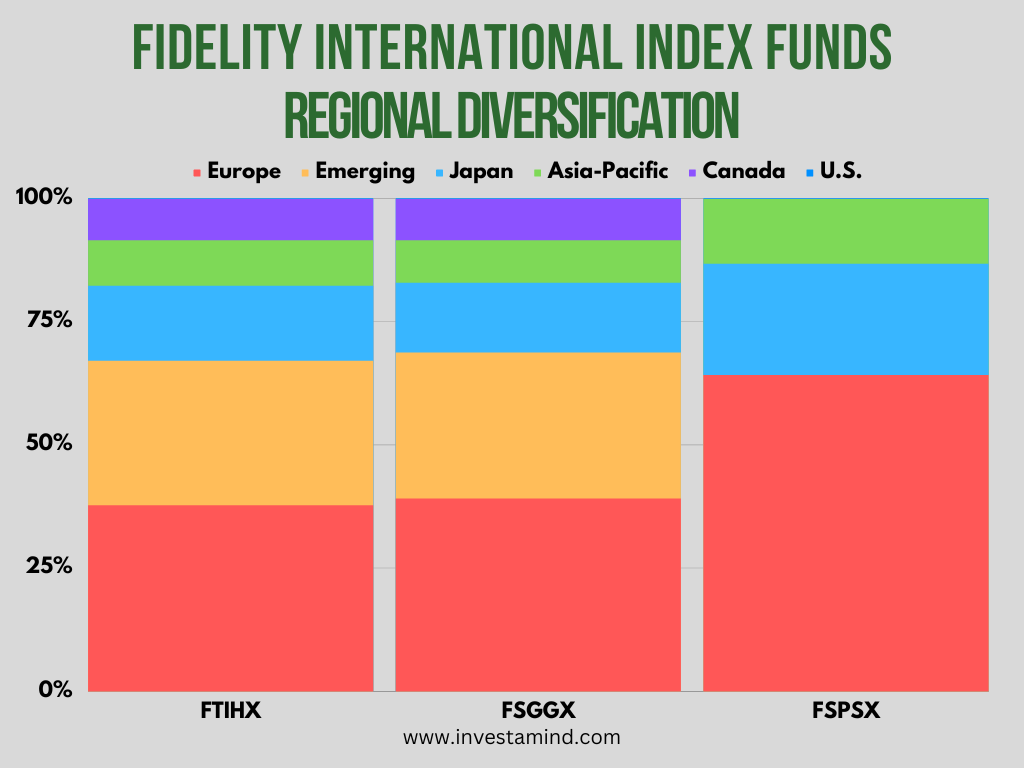

Regional Diversification

Finally, let’s take a look at the regions each fund invests in.

All three funds are heavily invested in Europe. As mentioned previously, FSPSX is the only fund that does not invest in emerging markets. If you take a look at the chart below, it also does not invest in Canada.

| FTIHX | FSGGX | FSPSX |

| Europe (39.30%) | Europe (40.37%) | Europe (64.47%) |

| Emerging Markets (29.33%) | Emerging Markets (29.63%) | Japan (22.55%) |

| Japan (15.19%) | Japan (14.15%) | Asia-Pacific excluding Japan (13.44%) |

| Asia-Pacific excluding Japan (9.24%) | Asia-Pacific excluding Japan (8.59%) | United States (0.13%) |

| Canada (8.34%) | Canada (8.38%) | Cash & Other Assets (-0.29%) |

| United States (0.14%) | United States (0.14%) | |

| Other (-1.54%) | Cash & Other Assets (-1.26%) |

Conclusion

Well, there you go – all of the information I found throughout my research.

As you can probably tell, FTIHX is the most diversified out of the three, which is why it’s the best Fidelity International Index Fund.

FSGGX is a close second, but it does not invest in small cap. It also uses “statistical sampling” to attempt to replicate the returns of the MSCI ACWI ex USA Index. I was not able to research this in more detail, but I’m not sure what this means. Nevertheless, I feel more comfortable holding an index fund that simply tracks its benchmark instead of using a type of sampling which I have no understanding of.

I hope my research was able to provide you with some value throughout your investing journey.

Do you use another brokerage than Fidelity? In this article, I talk about the best international index funds from Vanguard and Schwab as well.

More >> Saving money is an important part of investing. Learn 11 unique tips that can instantly boost your savings.

Thank you for reading and until next time!